what is tax planning and management

Difference Between Tax Planning. Tax planning is the fastest way to keep up with these modifications and stay prepared for any further changes as the pandemic continues.

Tax Planning Warning Tt Undefined Function 32 Tax Planning And Management Taxes Are The Studocu

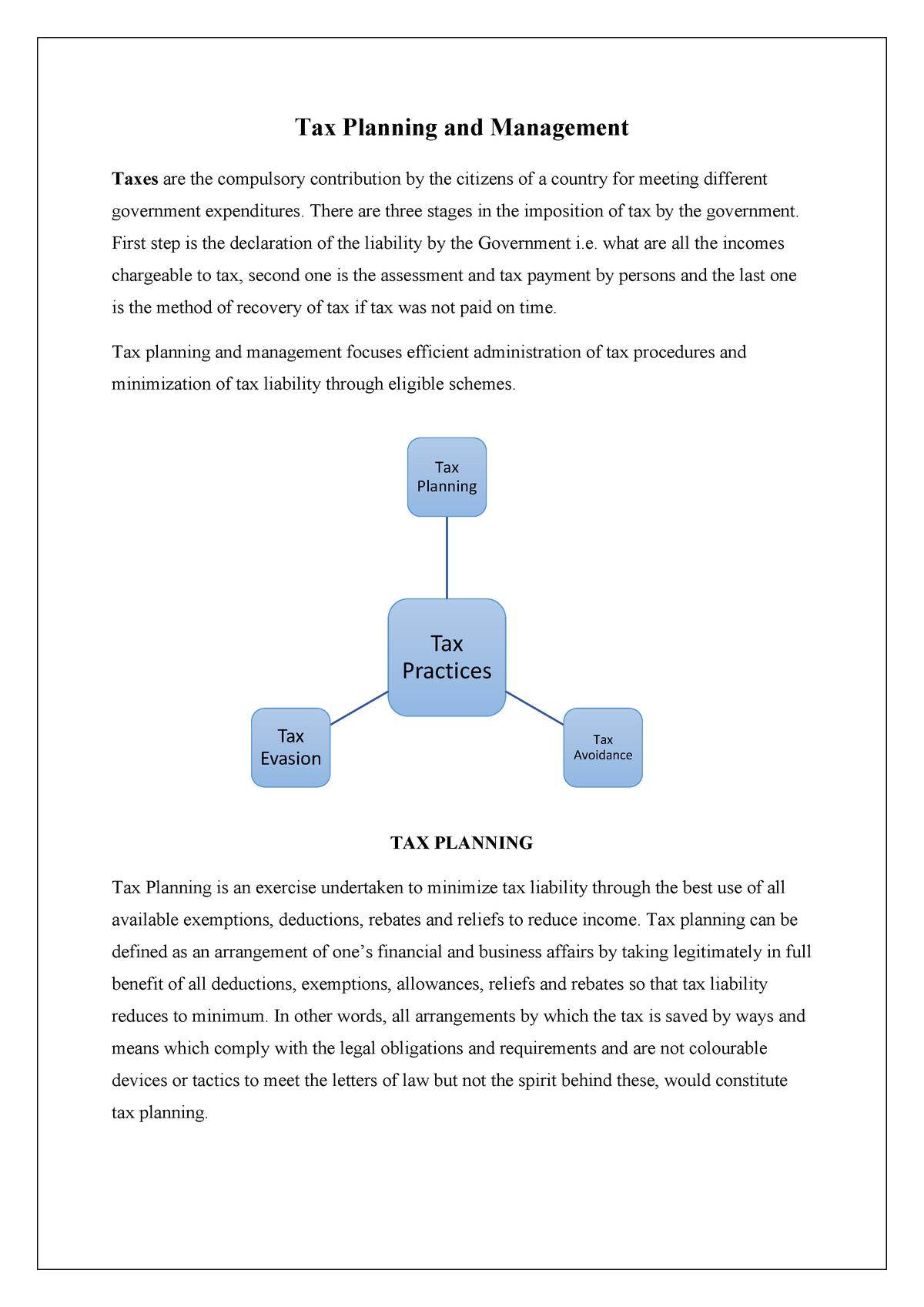

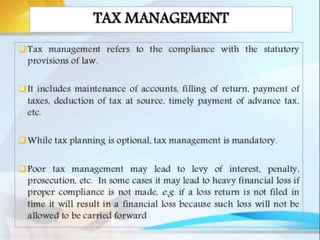

Tax planning refers to the practice of planning finances to achieve optimal tax savings while tax management is the practice of avoiding penalties by timely payment of.

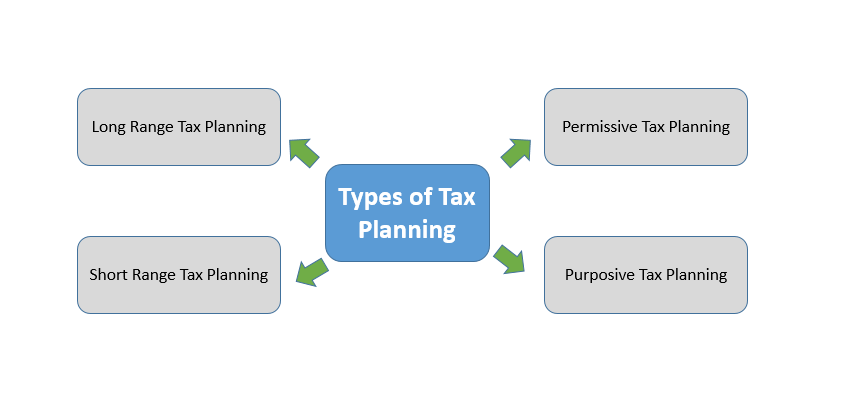

. Understand the objectives of tax planning in India and its various types along with their benefits and importance. Tax planning refers to financial planning for tax efficiency. Tax management is responsible for the timely filing of returns having accounts audited and.

It is a central piece of monetary preparation. Tax planning is about planning and filing tax returns while tax management is about maintaining financial records and taxes. For tax planning purposes determine whether the 0 15 or 20 capital gains rate will apply to you and whether to consider adjusting the timing of capital gains recognition.

The important thing is to recognize that you need it and take action. The objective of Tax. And more tax planning and management can be used for everyone from individuals to small businesses and more.

A sound tax plan requires all the. What is Tax Planning. In addition to saving people money tax planning strategies help taxpayers avoid tax penalties get the most from their tax deductions keep their financial documents organized and plan for the.

It aims to reduce ones tax liabilities and optimally utilize tax exemptions tax rebates and benefits as much as. Tax planning is the analysis and arrangement of a persons financial situation in order to maximize tax breaks and minimize tax liabilities in a legal and efficient manner. The term tax planning refers to analyzing an individuals financial situation to design investment and exemption strategies to ensure optimum tax efficiency.

The meaning of tax planning is very straightforward. Know more by clicking here. Corporate tax planning is something all new business owners should prioritise.

Tax planning generally deals with the planning of taxable income and investments of the assessee. Tax management is the management of finances for the purpose of paying taxes. I The Objective of Tax Planning is to minimize the tax liability.

Tax planning is a wider term and tax management is narrow term which is a part of tax planning. The main purpose of tax planning is to reduce. While tax planning and tax management correlate with each other the two aspects of taxes have several.

In a recent State of Owner Readiness Research Report a national and regional survey conducted by the Exit Planning Institute EPI61 of owners strongly agreed that. It is the investigation of ones financial situation from the point of view of tax efficiency. While on the other hand tax management is about the proper maintenance of.

Tax planning should take place well before its time to file tax returns. This is particularly the case if your business operates in more than one countryterritory eg. Tax planning emphasizes on tax minimization whereas tax management is compliance of.

Tax Optimization Tax Planning Bogart Wealth

Tax Planning Concept And Tax Planning With Specific Managerial Decisi

What Is The Importance Of Tax Planning By Wealth Management Partners Of Los Angeles Issuu

Personal Tax Planning Time Management Logos Free Transparent Png Clipart Images Download

Top 10 Tax Planning Strategies Save On Your Taxes Wealthability

2016 Review Of Income Tax Planning Systems

Tax Planning Tax Saving Tax Management Tax Consultant

Characteristics Tax Planning Management Ppt Powerpoint Presentation Show Graphics Example Cpb Powerpoint Templates

Tax Planning For Income Cornerstone Investment Group

Tax Planning Solutions Yeo Yeo

3 Strikes To Avoid When Tax Planning Cornerstone Wealth Management

Tax Planning Corinthian Wealth Management

Income Tax Planning Management Concepts Scope Differences Comparisons Youtube

Tax Planning Concepts Tax Planning All The Parties All The Taxes All Download Scientific Diagram

![]()

3 Strategies For Retirement Tax Planning Beacon Capital Management

Pdf The Impact Of Deferred Tax Expense And Tax Planning Toward Earnings Management And Profitability Semantic Scholar